Make order by Aliexpress - This is a difficult matter, since it is necessary to take into account many aspects, including the customs regulations of the country of the buyer. They play an important role for customers who, when ordering, exceed weight and price limits, will have to additionally pay customs duties. To learn the features of limits and customs payments, as well as the prospects for their changes, we propose to plunge into the world of customs legislation and wise advice from experienced buyers.

The content of the article

Duties on aliexpress

Today, Aliexpress services are used both wholesale buyers and customers who acquire goods for personal use. Many of them do not pay attention to the elementary purchase rules, which leads to problems when issuing, paying and receiving an order. A special place among these problems is the need for customs payments. It would seem that it would be a common practice, because in each country there are certain customs regulations, but in the case of AliacPress, it is possible to be in an unpleasant situation. This concerns retail buyers who sometimes have to pay a large percentage of the cost of goods. In such cases, the goods are purchased at a price much higher than in the stores of the buyer's country, therefore the order of goods with a foreign trading platform loses its meaning. In order not to be in such a situation, especially beginners, it is necessary to familiarize yourself with the rules for collecting customs duties.

By tradition, the costs of paying customs payments are assigned to the recipient, but there are cases when this burden takes on the sender. But customs duties on Aliexpress They are paid yet by recipients, since it is not always possible to know their size in advance, and therefore sellers do not want to risk and overpay.

Customs limit on Aliexpress

A pleasant moment when ordering on Aliexpress is an opportunity to avoid paying customs payments in certain cases. To do this, you must meet the established limits.

So, the customs limit on Aliexpress, as well as on other trading platforms and shops, is set at 1000 euros. At the same time, the weight indicator reaches a mark of 31 kg.

It is worth considering another characteristic when counting the price and weight indicator - a period of time, during which these limitations apply. According to the rules of customs legislation, an individual may acquire goods for personal use in the established limits within one month. Thus, throughout the month, a person can do both one and several orders, but the main thing is that they do not exceed 1000 euros and 31 kg. From the beginning of the new month, all the indicators are reset and you can make orders again.

If the limits are exceeded, then there will have to pay customs duties in such sizes - when an indicator of 1000 euros is exceeded, 30% of the amount, which is equal to the difference between the value of the goods and 1000 euros, but not less than 4 euros per 1 kg, in case of exceeding the weight norm . In the latter case, payment occurs for each kilogram exceeding 31 kg. If simultaneously there is exceeding and price and weight norms, then both indicators are calculated and the one that is maximum is taken.

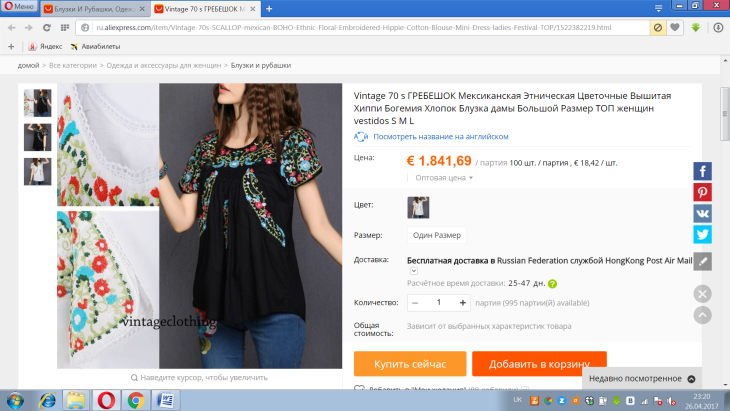

Customs duties on clothes on Aliexpress

Previously, general rules were described how customs duties are calculated. on clothes On Aliexpress and on other goods. Now it's time to learn about the exceptions.

The first in the list of exceptions is indivisible goods, the distinctive feature of which is the weight - it should be more than 35 kg. For them, a cumulative customs payment is provided, which is charged regardless of their value. The features of his calculus will be marked later.

There are no benefits for goods that are not intended for personal use. To understand which goods belong to this category, it is necessary to take advantage of a special list that is enshrined at the legislative level. Thus, employees of customs authorities at their own discretion cannot solve this kind of issues, but are guided by special rules.

The legislation provides for goods that are forbidden to import to the territory of the country. Therefore, such goods customs officers will not miss, and therefore the buyer in vain will spend money. For such cases provided return Procedure funds, but it takes time and nerves. So why to pre-promote yourself for an unsuccessful purchase if it can be avoided?

There are products that are fully exempt from customs payments. These include cultural values, as well as goods, the cost of which does not exceed 2 euros.

Internet purchase duty

It was time to consider the features of the cumulative customs payment, since the opportunity to buy goods with great weight on Aliexpress. Such a payment consists of several elements:

- internet purchase duty;

- excise;

- VAT.

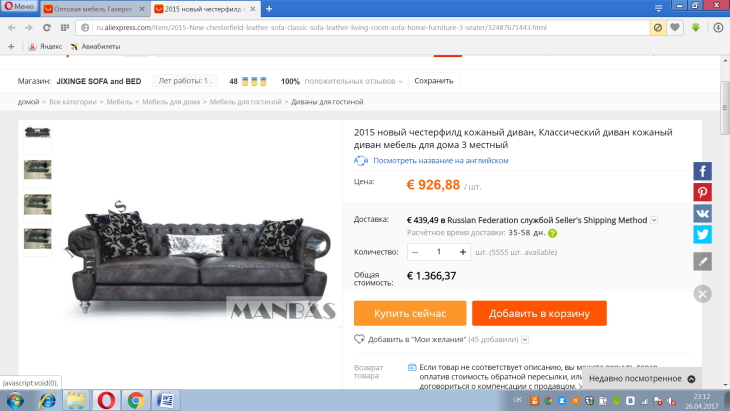

To find out the size of the duty, in this case it is necessary to take into account the code of the goods, which is provided by TNved. The nomenclature can be found in the network, but to understand the procedure for calculating the duty, we suggest to consider a simple example.

Suppose that the buyer ordered a kitchen set on the site, worth 800 euros and weighing 70 kg. At the same time, it is necessary to take into account the shipping cost - for example 150 euros. To find out the customs value headset, you need to add shipping cost to the cost of goods. In this case, it will be 950 euros.

After using the TC TC and determine the headset code, and therefore, the size of the duty is in our case it is 15%, but not less than 0.45 euros per 1 kg.

Starts to the calculations - 950 * 15% \u003d 142.50 and 70 * 0.45 \u003d 31.5. The maximum is the number of 142.50, so it is precisely it is taken for further calculations.

To calculate VAT, the amount of customs value and duties are taken and multiplied by 18% (VAT rate) - (950 + 142.50) * 18 \u003d 196.65.

Excise for this product is provided for in the amount of 0 and after all numbers are known, you can find out the final sum of the total customs payment:

142.50 + 196.65 + 0 \u003d 339.15 euros.

If the calculation is independently difficult, then you can use the online calculators available online.

Customs duties on Aliexpress

It was noted that there are products that, according to the legislation of the Russian Federation, are prohibited from importing into the territory of the country. Therefore, we offer to learn more about such a list, because as they say, it is aware, it means armed.

Many buyers attract a variety of spy gadgets, such as handles with a chamber or a listening device. At the same time, they may not be intended for professional use, but to be just innocuous toys. Customs such goods will not be accurate, because they are considered tools that are intended to illegal information.

On the forums you can find questions about what custom duties on alcohol on Aliexpress. It is worth upset buyers who would like to indulge themselves alcoholic beverages, as they relate to the prohibited to import. Therefore, customs duties will not be charged for them, because such goods will not fall to the buyer. The ban was also narcotic drugs and tobacco products.

The list of prohibited goods includes such that it is impossible to purchase on Aliexpress, namely radioactive substances, weapons, animals, explosives.

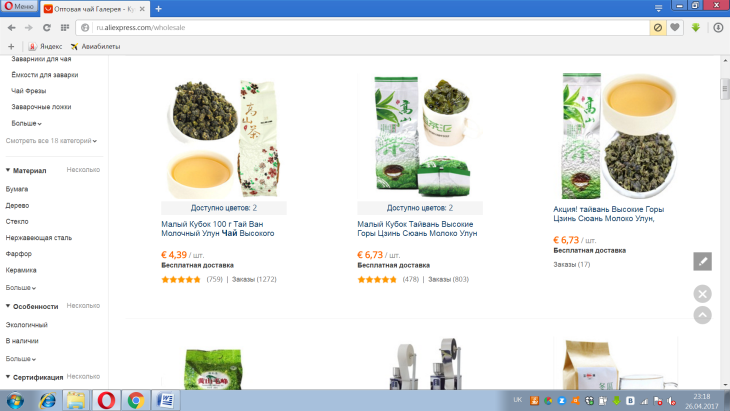

Customs duties for tea on Aliexpress

Tea is considered a commodity that takes the second place on sales to Ali Spress. And it is not surprising, because Chinese tea is famous for all over the world, and where to buy it, as not in the Chinese shopping area. The popularity of this product always causes the question of what customs duties for tea to Ali Spress. The answer to it is quite simple - if the goods do not fall under the exceptions, which were mentioned earlier, then the duties are paid on it according to the general rules. Thus, if you do not exceed the established limits, then you do not have to pay and duties.

It would seem that in this matter you can put a bold point, because the answer to the question is found. But recently there were reports that in a short time, tea on Aliexpress will not be sold.

To report this began buyers who, along with orders, tea came letters from sellers that this product will be prohibited. It is also indicated that the sellers informed their regular customers about it and in electronic form.

What caused the ban on this product is not yet clear, as is unknown, who became the initiator of such actions. There are assumptions that the future ban is entered for security purposes. It is believed that different forbidden substances can be transported under the guise of tea. Since the risk of missing them in mind due to large volumes at customs is great, a ban is required.

While the ban is not yet introduced, buyers can safely make orders, but still it is better to hurry to have time to pamper yourself exclusive tea.

How to buy goods without paying duties

There are cases when when ordering cannot be adhered to limits and then buyers have a question - how to buy goods without paying duties. The answer to this question is not even one, but if they are considered, we will adhere to only legitimate ways to exit the situation.

- If the order can be divided into several, then it is necessary to send it to different people. So you can avoid duties, since the limits will be calculated for each person separately.

- Specially reduce the amount of goods. This can be asked to ask the seller in correspondence, but there is a risk. If it is too low, then at the customs its employees can independently evaluate the goods and specify the real cost of goods. In this case, anyway will have to pay customs fees. Therefore, it is possible to use this method if the goods slightly exceeds the allowable limits.

- You can share an order for several shipments so that they go through customs at different times. It is important that the departments come at the end and at the beginning of the months, which are taken to calculate the permissible limits.

- If you need to purchase several identical goods, namely more than 5, then it is better to do several orders. This is due to the fact that the duty must be paid for the wholesale import, and such actions will avoid it.

- Resort to the help of intermediaries. Today there are many companies and private individuals involved in intermediary activities on Aliexpress. They can arrange and receive the goods, while taking a certain percentage of the cost of goods.

Finally, we note if the buyer has planned to make several small orders per month, then they should be recorded.

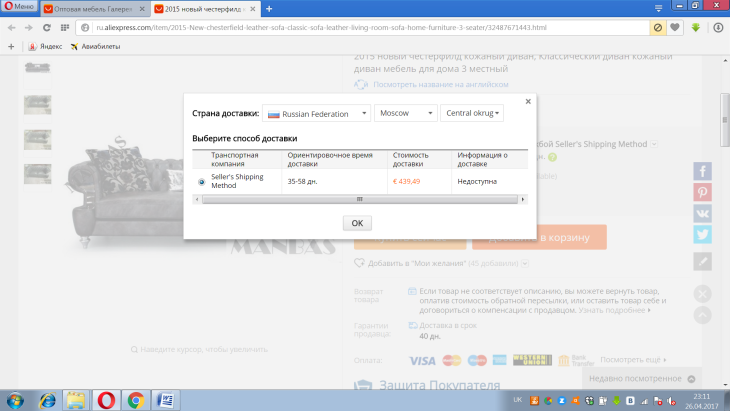

Payment of customs duties

Buyers who failed to place an order within the limits of the limits are interested in the question - how to pay Custom duty on parcels. To understand this issue, you need to refer to the customs regulations that regulate this procedure in detail. We offer to familiarize yourself with its important aspects:

- Individuals pay customs payments through the Cassus of Customs.

- Payment is made in national currency. If it is necessary to apply foreign currency, then for calculations, the currency is taken marked on the day of submission of the customs declaration.

- It is believed that the payer fulfilled his duty on the payment of customs duties after making money in the cash register of the customs authority (if the payment is made by cash) or after writing off the funds from the bank payer's account with cashless payment (this rule applies to payment through an ATM or terminal).

- If the payment of customs duties has not been made voluntarily, then it is possible to carry out forced recovery. In this case, the use of such a procedure to individuals is possible only in court.

AlyExpress duty video

Studying questions of the duty, you can see video materials in which the possible change in the established limits is reported. Therefore, we consider the prospects for changing the customs regulations and their consequences for both buyers and sellers.

At the moment, two projects have been developed that offer different approaches to this issue. In the first case, it is proposed to establish a price limit of 22 euros and weight in 1 kg. For parcels that will not exceed them, you do not need to pay customs duties. For all goods that will cost from 22 euros to 150 euros and weigh from 1 to 10 kg, it will be necessary to pay 15 euros. If the indicators of 150 euros and 10 kg are exceeded, then you will have to pay 30% of the customs value and an additional fee of 15 euros.

In the second project it is envisaged that for all goods worth up to 150 euros, you need to pay a fee of 10 euros.

It is believed that such changes are the right step towards the development of competition between foreign and national trading platforms. This is due to the fact that overseas sellers are not burdened with taxes, which cannot be said about domestic sellers. This makes it possible to first set low prices for their products and attract a large number of buyers. To level the chances of both sides and it is proposed to tighten the rules of duty-free import. For buyers, this means only one thing - foreign shopping will be not cheap. Consequently, national sellers will receive a chance to attract the attention of buyers and expand their sphere of influence.

Now all the secrets of customs rules are disclosed, but if you have questions, then we suggest watching a video about customs duties on Aliexpress.

Comments.