Are there any restrictions on the purchase of goods on Aliexpress. This question is interested in many avid buyers, since this marketplace is a real discovery for shopping. To determine the answer to this question, we suggest a little comprehend the basics of customs law. This will help learn not only the limitations on the monetary parameter, but also by weight, which is equally important.

The content of the article

Limit on orders for Aliexpress

If you contact the rules of purchases on this trading platform, then the cash limit by orders Aliaxpress is not installed. This means that you can safely order goods for any amount that the soul wishes. But there is one small "but". Intrigued? The thing is that when buying goods in foreign online stores, customs regulations must also be taken into account. Experienced buyers know the excess of the limits established by the country established by the customs legislation may be displayed on the family budget. After all, if you exceed certain indicators, you will have to pay a customs duty. But let's understand everything in order.

In 2010, at the legislative level, unified limits of the weight and monetary indicator were established, within which the delivery of goods is carried out without the recovery of customs duties. At the same time, such limits are the same for all organizations that are engaged in the processing of postal shipments, regardless of whether they are public or private legal entities.

Another feature of such limits consists in the fact that they are provided for a period of one month.

Thus, the maximum monetary rate for parcels from abroad is 1000 euros per month. As for the weight, he reaches the mark - 31 kg.

Considering these indicators, the buyer can adjust its orders and try to meet the permissible limits. Otherwise, customs duty can not be avoided, but is it really so big that you need to carefully make counting your parcels within a month?

AlyExpress duty for orders

Many know that the excess of the norm and the cost of the order will lead to the obligation to pay the customs duty. But only a few understand the essence of this concept. If it is simple, then this is a certain amount of money that will need to be paid in case of exceeding the limits. Turning to the legislative base and the theory of jurisprudence, the following characteristic signs of customs duty can be distinguished, responding to the following questions:

- What is the duty? - This is a mandatory payment.

- In what cases does it charge? - When moving goods across the customs border.

- What state authorities are authorized by charging? - Customs.

- What is the fulfillment of the obligation to pay it? - Measures of state coercion, including legal responsibility, both administrative and criminal.

As you can see, this payment is not in vain called mandatory, because the consequences of non-payment can be deplorable. So that this does not happen, remember two main indicators - 1000 euros and 31 kg. The most slightest exceeding - and you have to pay.

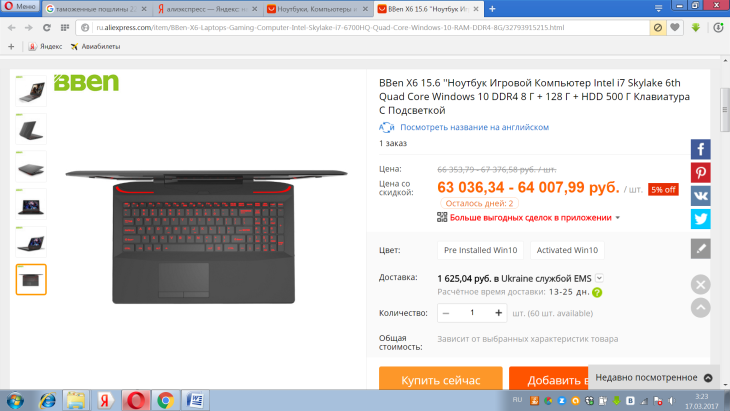

What duty on orders for aliexpress. Responding to this question you need to use the standard rules.

So, if permissible limits exceed, then 30% of the cost of goods is paid, but not less than 4 euros per 1 kg (pay attention, not the entire amount or weight is taken into account, but only those that exceeded limits).

For example, the weight of the parcel is 25 kg (this is within the limits permissible), but the cost of 1500 euros, then the calculation of the duty will be carried out according to the following formula - (1500-1000) * 30% \u003d 500 * 0.3 \u003d 150 euros.

If the weight of the parcel is 36 kg, and the cost of 700 euros (this is within the norm), then the calculation will be carried out according to the formula - (36-31) * 4 \u003d 20 euros.

It may also happen that there will be both indicators to exceed the limit, then the sums on the two formulas are calculated and the maximum amount is taken.

Customs duty on products from Aliexpress

The listed rules for charging duties relate to many products. But both in any rule there are exceptions, and in this case several clarifications are provided.

Thus, customs duty on products from Aliexpress It will be charged differently or will not be charged at the following cases.

The first - concerns the so-called, indivisible goods. Do not think that this is a product that cannot be divided into any way. It is completely different here. Industry is the goods, if such signs are inherent:

- total weight - more than 35 kg;

- may consist of one or a set of goods;

- must be completed.

In this case, the customs payment is charged, which was called - cumulative. His features, structure and settlement procedure Consider a little later.

The second exception is the goods that do not belong to personal consumption goods. Of course, it is not necessary to guess here, because a list with a specific list of such goods has been drawn up. To them, among other things, belong:

- solarium for sunburn;

- diamonds;

- medical equipment;

- hairdressers.

For such goods will also be charged a cumulative customs payment.

The third and fourth category includes goods that are either generally prohibited or limited to import. There is also a clear list of such goods, which will look at the details later.

The fifth exception concerns the cultural values \u200b\u200bthat are subject to compulsory declaration in writing. But at the same time they are exempt from duties, regardless of the exceeding the limits.

The last exception concerns not some particular product. This category includes goods for which customs payments must be paid, but their size is less than 2 euros. In such cases, duties are not charged.

Customs duties on goods from China to Russia

It may happen that it is necessary to order a product that will exceed the established limits, but at the same time you do not want to pay a duty. What to do in this case? And are there any legitimate ways to bypass such rules? Since the principle of legal relations are provided for citizens "All that is not prohibited," experienced buyers have come up with several tricks that can help.

- If the order amount exceeds the mark of 1000 euros, then the customs duties on goods from China to Russia can not be paid if you make orders for different people. Some are also recommended for loyalty to use different addresses.

- The second secret of the right order is an indication in the "cost" column that the goods are a gift. You can agree on this in advance with the seller using the online form of feedback. The only drawback of this method is the powers of customs officers. They have the right, in case of suspicion, independently evaluate the goods. As a result, if the purchase took place at low prices, and the customs officer will indicate the real value, the buyer will remain in the loss.

- The risky is considered to be a way of intentional progress, so that the amount as a result does not exceed the limit of 1,000 euros. All unreliability is all in the same powers of customs officers independently evaluate the goods. If the understatement is significant, then payment fees cannot be avoided. This option is suitable only for cases if the understatement is insignificant.

- Intermediary services is another legitimate way that will cost a certain SUMA from the goods (remuneration for the work of the intermediary).

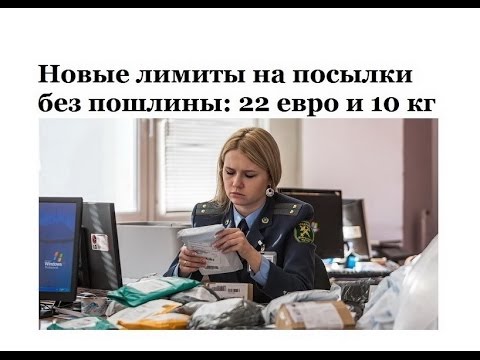

New limits on parcels from Aliexpress

The rapid popularity of foreign online stores did not yet be ignored by state authorities and the public. This is due to the low competition of Russian trading platforms on the Internet, since the prices of their products are significantly higher. To stabilize the situation in this aspect, work began on the formation of new restrictions. Such activities brought their fruits, and now you can get acquainted with two versions of acts that secure new limits At the parcel from Aliexpress and from other overseas online stores.

The first option suggests that the goods whose cost is up to 150 euros, a collection of 10 euros will be charged.

The second option involves a more flexible system of calculating and dividing goods. If earlier online shopping lovers had 31 kg and 1000 euros in their reserve, then in the future these indicators can decrease to 1 kg and 22 euros. It is these limits that offer to be installed to exemplate from the duty.

The fee of 15 euros will have to pay buyers whose goods over 1 kg, but not more than 10 kg. The same collection is provided for monetary from 22 to 150 euros.

And in conclusion, duties for exceeding the indicators. In this case, the total amount will be calculated from two separate figures - the first is the first euro collection, which is unchanged and the second - 30% of the cost of goods.

As you can see, big changes are coming, so enjoy the possibility of cheap shopping, while this pleasure has not turned into a real luxury.

Taxes on Aliexpress

Paying attention to the obligatory payments, which are provided for by order of goods in foreign online stores, it costs to note such a type of customs payment as cumulative. Recall that it concerns two types of products - indivisible and which are not intended for personal use.

The peculiarity of such a customs payment in its components. It is believed that it includes three types of mandatory payments:

- duty;

- excise;

- VAT.

If the first has already been said a lot, then you should figure it out in two others. EXCIZ is a tax that is established within the country on items are intended for mass consumption (alcoholic beverages, tobacco products, ethyl alcohol).

VAT (value added tax) is a type of compulsory payment, which is considered a form of seizure in the treasury part of the value of goods. In Russia, he undergoes 18%, but tax rates in the amount of 10% and 0% are also possible.

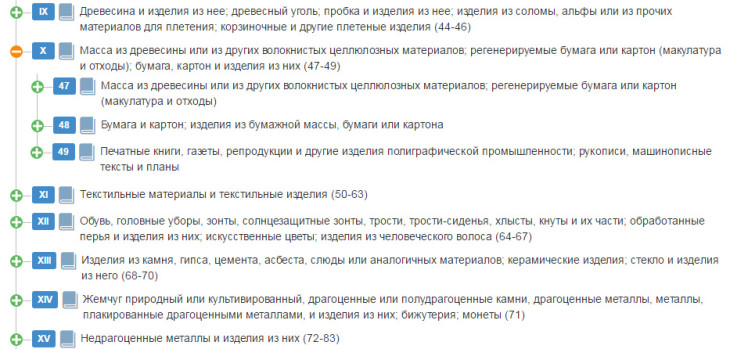

In order to correctly calculate the cumulative customs payment, it is necessary to get acquainted with the TN WED, which contains the codes of the goods (this base is in free access). Having determined the product code, you can learn and import duties, whose indicators are important when calculating.

First, the dimensions of all required payments are learned. To calculate the duty, the customs value is necessary (includes the cost of goods + shipping cost) multiplied by an index of import duty.

VAT is found in the summing of customs value and duties, and 18% calculated from the result obtained. The exclusion indicator can also be viewed by TN VED.

When you get amounts for all three payments - summarize them and the final amount of the total customs pay is obtained.

Thus, calculate taxes on Aliexpress Simply, the main thing is for patience and calculator.

Restrictions for Russia for orders for AlExpress

The first restrictions for Russia on orders for Aliexpress, which is worth paying attention to, this is a list of goods prohibited for importation into the territory of the state.

There is an officially approved list of such goods with which you can familiarize yourself on the network. Among the most popular who can attract the attention of many buyers can be allocated:

- plants regardless of the type and genus (in the same category also include plants dried or treated with special means, including their collection);

- weapons or parts of them, cartridges, as well as any other products that are reminded by designs such products;

- drugs and alcohol, regardless of the type;

- tobacco products, including different smoking mixtures;

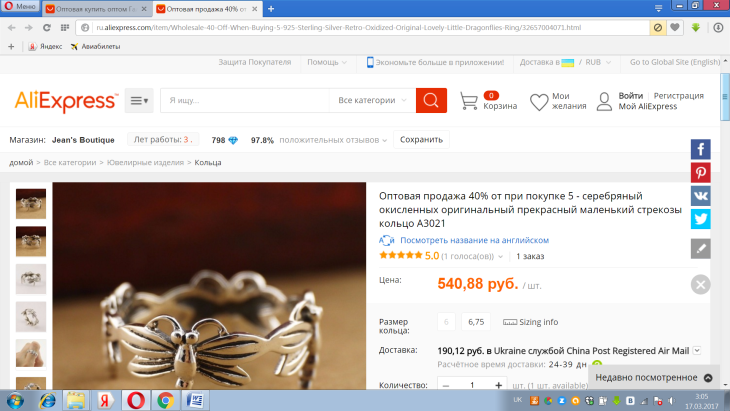

- precious stones (with the exception of jewelry);

- cultural values;

- animals;

- products that have a property quickly deteriorate.

According to experienced buyers, the customs forbidden to import goods may also be aligned (biologically active additives for food) and sports nutrition. There is a risk of not getting products that are reminded by their device spy gadgets - knobs, key chains or other items with cameras and listening devices.

Remember, in such cases it is possible to confiscate the goods at customs. Therefore, do not waste money in vain and avoid such orders.

Restrictions on orders for Aliexpress

The problem we will consider in this block indirectly concerns the restrictions on orders for Ali SPress. These are the features of the recognition of the goods of the commercial party for which there is no prohibition, but for buyers it can significantly appear on finance.

The fact is that you can order several identical products in order to give them to relatives and friends. But employees of customs authorities may consider such a batch of commercial, that is, intended for distribution in order to obtain profits.

The consequence of such a decision for the buyer who is an individual is considered to be the need for the design of goods in general, provided for by customs legislation. This means you need a cargo customs declaration and as a result of payment of duties in full.

In order not to get into such situations and do not overpay, it is recommended to share a large number of the same product for several parties. You can agree on this in advance with the seller and thus do not cause doubts from the customs.

Now online shopping lovers will be able to make purchases and avoid payment of customs payments. The main thing is that the limits are now spent as long as possible, and allowed to order more good products. If you still have questions about the topic considered, then we suggest watching a video about how much per month can be bought on Aliexpress.

Comments.