Buying things in domestic online stores, no one thinks about such aspect as a customs duty. And it is right, because in such cases it is not charged. But many buyers who make online shopping on Aliexpress Forget about this issue and sometimes overpays for the goods a crucible suma. In order not to get into a similar trap, you need to learn about all the intricacies of this issue. Therefore, we suggest to pay for several minutes to such theme and protect yourself in the future from unnecessary spending.

The content of the article

Customs duties on goods with Aliexpress

Before proceeding to the consideration of the quantitative aspect of this issue, it is necessary to understand why customs duties are needed and what is their feature.

Customs duty is a mandatory payment, which is charged to customs. In addition, customs executables two more functions. The first one is ensuring that people, acquiring goods abroad, comply with all the requirements of tax and customs legislation. The second - is trying to avoid entering the territory of the state of items that are prohibited for the importation.

If you want to place an order from a foreign trading platform, you will have to get acquainted in detail with all customs rules. Otherwise, you risk for cheap goods to pay extra for a decent amount.

The first thing you need to know are customs duties on the goods AlExpress assigned to the buyer, and not on the seller. It also means that if when customs passage, a product that is prohibited for importation will be discovered, then will still look for the customer and make a claim to it.

It is worth remembering that there are limits, sticking to which you do not have to pay a duty. At the same time, consider who makes an order is a physical or legal person, because for each of them there are its standards.

Interestingly, experienced buyers managed to come up with several ways to avoid payment of customs duties, and even tested them in practice. Therefore, let's get acquainted with all aspects associated with these mandatory payments.

Purchase duty size with Aliexpress

Back in 2010, the legislative levels identified the same customs payments for all organizations that are engaged in postal shipments. Below will be the limits that apply to individuals.

To exemplate from paying a duty, it is necessary to follow these rules:

- weight - no more than 31 kg;

- cost - less than 1000 euros;

- the sum of all goods ordered per month for the month is less than 1000 euros.

If the specified rules are not observed, then the size of the purchase fees with Aliexpress will be charged in such sizes - when weight exceeded - 30% of the cost of goods, but not less than 4 euros per 1 kg.

A duty is charged only for exceeding indicators, and not for the entire weight or cost of such a product. If you are exceeded at once in two standards, then the maximum amount is paid, and it must be in rubles.

Duty by shoes With Aliexpress or on other types of goods, it is charged under the specified scheme, but both in any rule and there are exceptions here. This applies to cultural values, goods that cannot be imported into the territory of the country or which are not intended for personal use. This number also includes this type of goods as indivisible. They can be distinguished on two characteristic features: the total weight of more than 35 kg, and the purpose is for personal purposes.

In all the above cases, the duty on goods with Aliexpress will be charged either by other rules, or will not be charged at all.

PUB FOR Chinese

As they say, each rule is created in order to break it. In this case, we will not talk about violations, but consider legitimate ways that will help bypass the established rules for charging customs duties.

If you need to order several products worth more than 1000 euros, then you can order on different people and at different addresses. In this case, the duty does not need to pay, but the goods will still have it.

Many buyers ask sellers to indicate the price that will be below 1,000 euros. In general, this option is suitable if the difference in the price of the real and the specified will be insignificant. But do not forget, customs officers have the right to specify the real value and charge the duty for all the rules. Therefore, you can spend more than planned.

Another way is to use the services of intermediaries. They can solve independently all questions arising at customs, but for their services they take a certain percentage of goods - most often it is 10%.

It is worth remembering that the customs duty can charge for the wholesale import of goods (the importation of 5 or more objects can be considered wholesale). In this case, it is recommended to split a batch into several orders - you can avoid duty for the wholesale import.

You can hear the recommendation that it is necessary to ask the seller to indicate the word "gift" in the "cost" column. But it is worth carefully to treat this option, because in practice, customs officers in this case independently evaluate the goods. Thus, the cost may turn out more than if the seller himself pointed it.

As you can see, the duty on chinese goods It may not always be charged, the main thing about to approach this issue.

Taxes on Aliexpress

Previously, it was noted that for indivisible goods (their weight more than 35 kg) there is a separate collection of fees. So, the cumulative customs payment will be charged, which includes such types of mandatory payments:

- duty;

- excise tax - the national tax, which is established on the items of mass consumption;

- VAT - the tax on the added value is 18%.

We offer on a simple example to consider how the final payment amount will be calculated in this case.

Suppose that it is planned to purchase a sofa weighing 40 kg and worth $ 600. At the same time, the shipping cost will be $ 180.

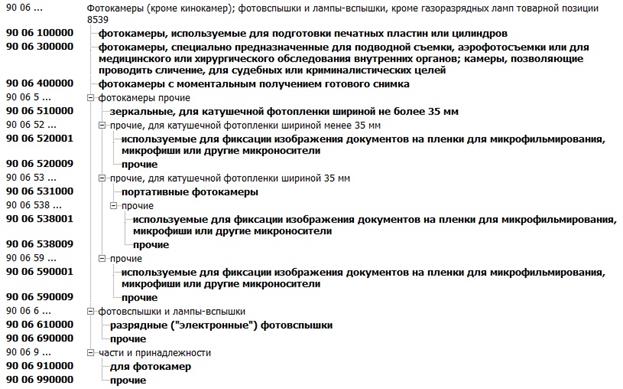

Before you begin the calculation, you need to know which code has a product in accordance with the TN VED TS (this base is freely available for familiarization and use).

In this case, the code 9401400000 for which the customs duty rate is provided in the amount of 15% of the customs value, but not less than 0.7 euros per kg. As for the excise, it is equal to 0, and VAT is 18%.

Now you can go to the calculations:

- we learn the customs cost of furniture - $ 600 (the cost of furniture) + $ 180 (shipping cost) \u003d 780 $;

- duty - 780 $ * 0.15 \u003d 117 $ (if you count from the cost); 40kg * 0.7 euro \u003d 28 euros (if you count by weight) - for further calculations, the amount is taken, which will be more, in this case, $ 117;

- VAT - (780 $ + 117 $ \u003d 897 $) * 0.18 \u003d $ 161.46;

- total payment amount - $ 117 + $ 161.46 \u003d $ 278.46.

It is for such a scheme that taxes need to be calculated on Alikespers.If the goods have all signs of indivisible.

Restrictions on the import of goods from China

To deal with a foreign online store, you need to know more and which goods can not be imported into Russia. Otherwise, it is impossible to receive the parcel and will have to carry additional costs. In the network you can find a complete list of such goods, while it is the same with any international shipments. So, we suggest to consider some of these goods that I would like to purchase at low prices, but it is impossible:

- weapon;

- drugs;

- alcohol;

- cigarettes;

- perishable goods;

- animals and plants;

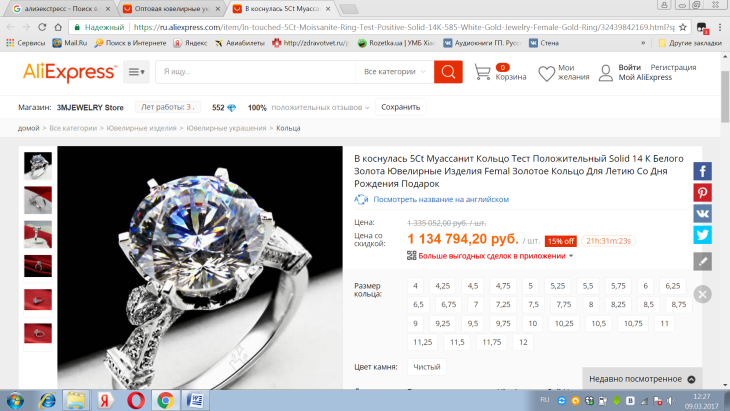

- precious stones (exception to become jewelry).

As you can see, restrictions on the import of goods from China are similar as for other countries. Therefore, consider this information and do not create yourself unnecessary problems. Remember, in advance familiarization with the rules of international shipments will help make an order with the mind and avoid trouble with state authorities.

Current information about the purchase date on the Internet

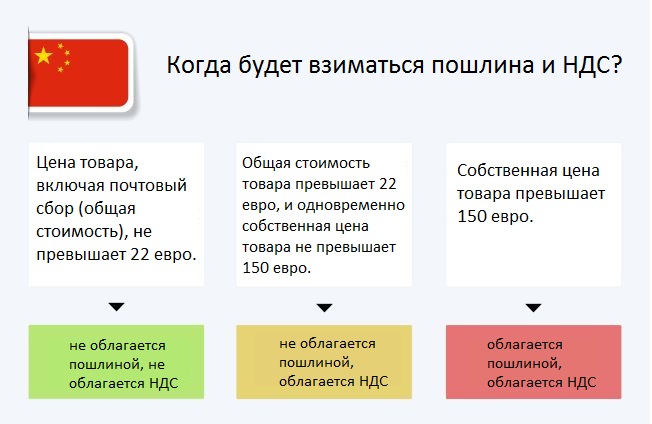

All the above rules for calculating and the size of duties and taxes are valid at the moment. But you should not think that in a short time nothing will change. Now the legislators have been actively treated for reforming the procedure for regulating international Internet commerce. It is planned to change the established limits for shipping goods without charging customs duty. At the same time, two different options for solving such a problem were prepared.

In the first case it is assumed:

- goods up to 1 kg and up to 22 euros - freed from duty;

- goods from 1 to 10 kg and from 22 to 150 euros - the collection of 15 euros;

- in other cases - the collection of 15 euros + 30% of the cost of goods.

According to another project, the charges of 10 euros will be addressed the goods whose cost is up to 150 euros.

For buyers, both the first and the second option does not imply nothing good. But experts in this area consider such dimensions necessary and, moreover, they correspond to international practice. These changes will also contribute to the development of healthy competition of Russian online merchants with overseas.

Recall that this is up-to-date information about the duty on shopping on the InternetBut it has not yet been legalized. Therefore, hurry to make purchases on Aliexpress, because in a short time it can become not cheap.

Clothing duty with Aliexpress

Clothing is considered popular products on this shopping area. Therefore, it is worth learn how duty on clothes Aliexpress. In general, the above rules apply to all types of goods, so they can be applied to clothing. But it is necessary to pay attention to the peculiarities of sending goods and the ability to abandon it in the event of an imposition of customs duty.

Information about the order comes to the seller immediately after its design, and from that moment he begins to form it. For each seller, this period may take different amounts of time, but you can learn about it in the list of purchases under each product in the item - Processing Time. As for the delivery time, it can be from 20 to 60 days (but possible and faster). During this period, the parcel also passes and customs, so in the event of problems, it will have to solve them quickly, if you do not want to wait for your product for a long time.

If when ordering the goods it was assumed that a duty will be imposed on it, but for some reason, customs officers still did it - do not hurry to get upset. You can not pay for the goods and abandon it, but for this enough to open dispute on aliexpress and set out the situation. If documents are available, which will confirm the refusal of sending and sending it to China, you can add them to the dispute. Most often, such disputes are solved in favor of the buyer - the only drawback - you will have to pay for the seller all transportation costs.

Rules for payment of goods for Aliexpress

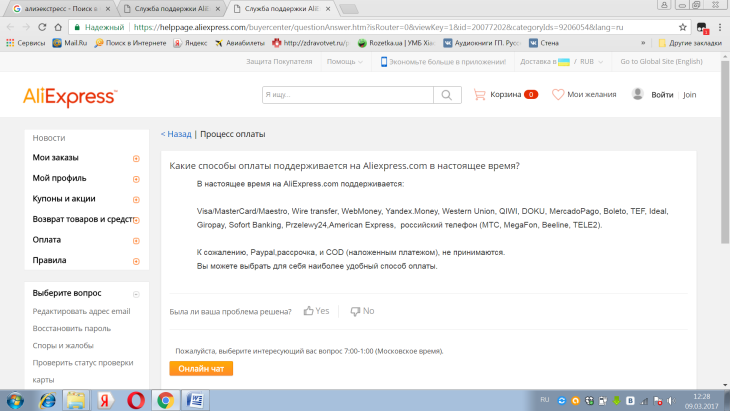

Considering rules of payment for goods On Aliexpress, it can be concluded that in general it is a fairly simple and convenient procedure. This is due to the fact that the buyer is offered several payment methods, so we suggest to consider some of them and learn their features.

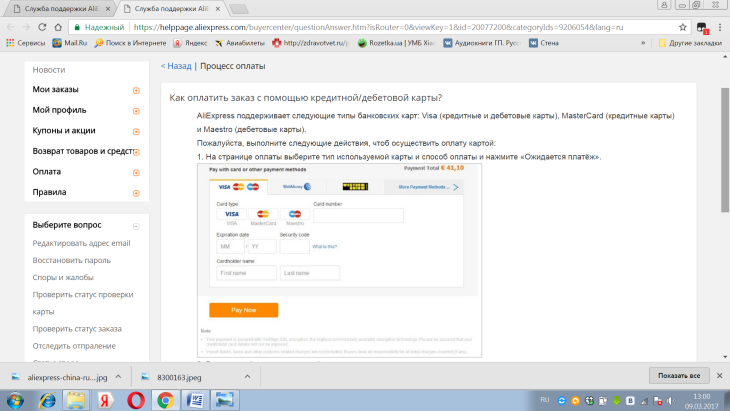

Traditional is the method of payment by a credit-debit card, the advantage of Aliexpress in this case is that the buyer is not limited to a certain type of bank cards. At the moment you can use such types as:

- Visa (credit and debit cards);

- MASTERSARD (Credit Cards);

- Maestro (debit cards).

To take advantage of this method of payment, enough in certain fields on the payment page enter information about the map and the payment will be implemented.

As for other payment methods, some of them have certain limits that need to be considered. So, the QIWI is set to the maximum and minimum payment size - 0.05 USD to 5000 USD. There is no maximum on the Wire Transfer and Western Union, but there is a minimum - 20 USD.

Among other popular methods, you can select Alipay, Webmoney, American Express and Yandex.money.

Thus, do not allow many buyers' errors, and before ordering products to Aliexpress carefully read the characteristics of customs duties. Only so you can protect yourself from extra spending and get the right thing really for a substantially low price. If you have any questions on this topic, then see the video about goods duties Aliexpress.

Comments.